Official Node client for Sales Tax API v2. For the API documentation, please visit https://developers.taxjar.com/api/reference/.

Requirements

Installation

Authentication

Usage

Custom Options

Sandbox Environment

Error Handling

Testing

- Node.js v10.0 and later.

npm install taxjar

// CommonJS Import

const Taxjar = require('taxjar');

// ES6 Import

// Using TypeScript? Pass `esModuleInterop` in tsconfig.json

// https://www.typescriptlang.org/docs/handbook/compiler-options.html

import Taxjar from 'taxjar';

const client = new Taxjar({

apiKey: process.env.TAXJAR_API_KEY

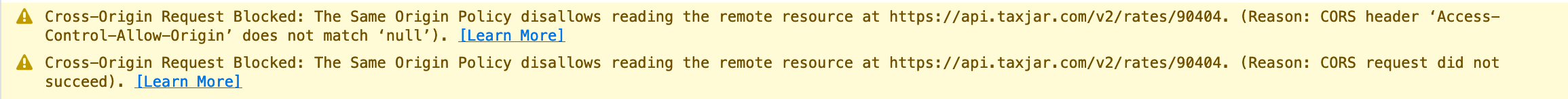

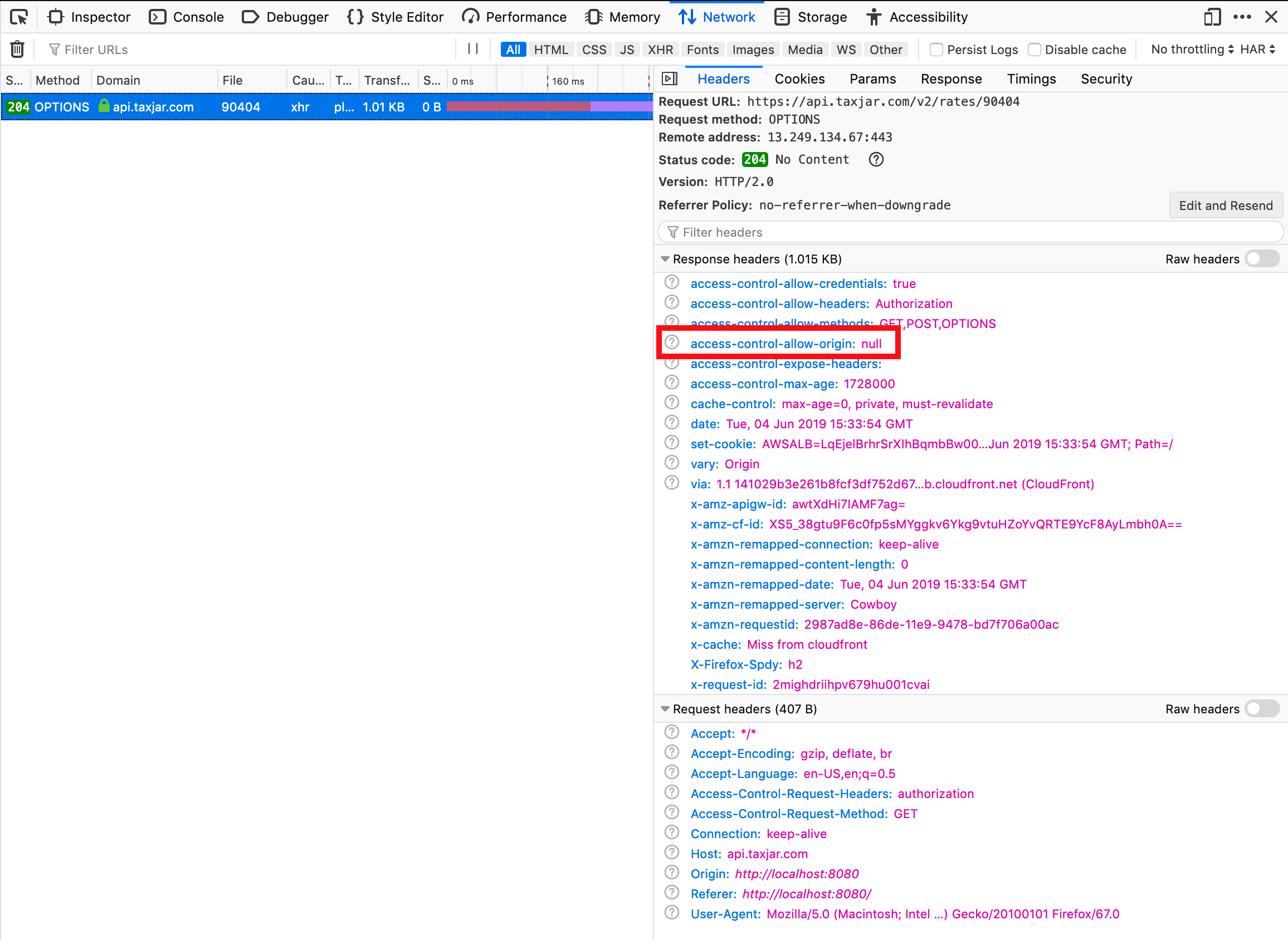

});Warning: Never expose your API token in client-side JavaScript. This is insecure and could put your TaxJar account at risk.

You're now ready to use TaxJar! Check out our quickstart guide to get up and running quickly.

categories - List all tax categories

taxForOrder - Calculate sales tax for an order

listOrders - List order transactions

showOrder - Show order transaction

createOrder - Create order transaction

updateOrder - Update order transaction

deleteOrder - Delete order transaction

listRefunds - List refund transactions

showRefund - Show refund transaction

createRefund - Create refund transaction

updateRefund - Update refund transaction

deleteRefund - Delete refund transaction

listCustomers - List customers

showCustomer - Show customer

createCustomer - Create customer

updateCustomer - Update customer

deleteCustomer - Delete customer

ratesForLocation - List tax rates for a location (by zip/postal code)

nexusRegions - List nexus regions

validateAddress - Validate an address

validate - Validate a VAT number

summaryRates - Summarize tax rates for all regions

List all tax categories (API docs)

The TaxJar API provides product-level tax rules for a subset of product categories. These categories are to be used for products that are either exempt from sales tax in some jurisdictions or are taxed at reduced rates. You need not pass in a product tax code for sales tax calculations on product that is fully taxable. Simply leave that parameter out.

client.categories().then(res => {

res.categories; // Array of categories

});Calculate sales tax for an order (API docs)

Shows the sales tax that should be collected for a given order.

client.taxForOrder({

from_country: 'US',

from_zip: '07001',

from_state: 'NJ',

from_city: 'Avenel',

from_street: '305 W Village Dr',

to_country: 'US',

to_zip: '07446',

to_state: 'NJ',

to_city: 'Ramsey',

to_street: '63 W Main St',

amount: 16.50,

shipping: 1.5,

line_items: [

{

id: '1',

quantity: 1,

product_tax_code: '31000',

unit_price: 15.0,

discount: 0

}

]

}).then(res => {

res.tax; // Tax object

res.tax.amount_to_collect; // Amount to collect

});List order transactions (API docs)

Lists existing order transactions created through the API.

client.listOrders({

from_transaction_date: '2015/05/01',

to_transaction_date: '2015/05/31'

}).then(res => {

res.orders; // Orders object

});Show order transaction (API docs)

Shows an existing order transaction created through the API.

client.showOrder('123').then(res => {

res.order; // Order object

});Create order transaction (API docs)

Creates a new order transaction.

client.createOrder({

transaction_id: '123',

transaction_date: '2015/05/14',

from_country: 'US',

from_zip: '92093',

from_state: 'CA',

from_city: 'La Jolla',

from_street: '9500 Gilman Drive',

to_country: 'US',

to_zip: '90002',

to_state: 'CA',

to_city: 'Los Angeles',

to_street: '123 Palm Grove Ln',

amount: 17.45,

shipping: 1.5,

sales_tax: 0.95,

line_items: [

{

id: '1',

quantity: 1,

product_identifier: '12-34243-9',

description: 'Fuzzy Widget',

unit_price: 15.0,

discount: 0,

sales_tax: 0.95

}

]

}).then(res => {

res.order; // Order object

});Update order transaction (API docs)

Updates an existing order transaction created through the API.

client.updateOrder({

transaction_id: '123',

amount: 17.45,

shipping: 1.5,

line_items: [

{

quantity: 1,

product_identifier: '12-34243-0',

description: 'Heavy Widget',

unit_price: 15.0,

discount: 0.0,

sales_tax: 0.95

}

]

}).then(res => {

res.order; // Order object

});Delete order transaction (API docs)

Deletes an existing order transaction created through the API.

client.deleteOrder('123').then(res => {

res.order; // Order object

});List refund transactions (API docs)

Lists existing refund transactions created through the API.

client.listRefunds({

from_transaction_date: '2015/05/01',

to_transaction_date: '2015/05/31'

}).then(res => {

res.refunds; // Refunds object

});Show refund transaction (API docs)

Shows an existing refund transaction created through the API.

client.showRefund('123-refund').then(res => {

res.refund; // Refund object

});Create refund transaction (API docs)

Creates a new refund transaction.

client.createRefund({

transaction_id: '123-refund',

transaction_reference_id: '123',

transaction_date: '2015/05/14',

from_country: 'US',

from_zip: '92093',

from_state: 'CA',

from_city: 'La Jolla',

from_street: '9500 Gilman Drive',

to_country: 'US',

to_zip: '90002',

to_state: 'CA',

to_city: 'Los Angeles',

to_street: '123 Palm Grove Ln',

amount: -17.45,

shipping: -1.5,

sales_tax: -0.95,

line_items: [

{

id: '1',

quantity: 1,

product_identifier: '12-34243-9',

description: 'Fuzzy Widget',

unit_price: -15.0,

discount: -0,

sales_tax: -0.95

}

]

}).then(res => {

res.refund; // Refund object

});Update refund transaction (API docs)

Updates an existing refund transaction created through the API.

client.updateRefund({

transaction_id: '123-refund',

transaction_reference_id: '123',

amount: -17.95,

shipping: -2.0,

line_items: [

{

id: '1',

quantity: 1,

product_identifier: '12-34243-0',

description: 'Heavy Widget',

unit_price: -15.0,

discount: -0,

sales_tax: -0.95

}

]

}).then(res => {

res.refund; // Refund object

});Delete refund transaction (API docs)

Deletes an existing refund transaction created through the API.

client.deleteRefund('123-refund').then(res => {

res.refund; // Refund object

});List customers (API docs)

Lists existing customers created through the API.

client.listCustomers().then(res => {

res.customers; // Customers object

});Show customer (API docs)

Shows an existing customer created through the API.

client.showCustomer('123').then(res => {

res.customer; // Customer object

});Create customer (API docs)

Creates a new customer.

client.createCustomer({

customer_id: '123',

exemption_type: 'wholesale',

name: 'Dunder Mifflin Paper Company',

exempt_regions: [

{

country: 'US',

state: 'FL'

},

{

country: 'US',

state: 'PA'

}

],

country: 'US',

state: 'PA',

zip: '18504',

city: 'Scranton',

street: '1725 Slough Avenue'

}).then(res => {

res.customer; // Customer object

});Update customer (API docs)

Updates an existing customer created through the API.

client.updateCustomer({

customer_id: '123',

exemption_type: 'wholesale',

name: 'Sterling Cooper',

exempt_regions: [

{

country: 'US',

state: 'NY'

}

],

country: 'US',

state: 'NY',

zip: '10010',

city: 'New York',

street: '405 Madison Ave'

}).then(res => {

res.customer; // Customer object

});Delete customer (API docs)

Deletes an existing customer created through the API.

client.deleteCustomer('123').then(res => {

res.customer; // Customer object

});List tax rates for a location (by zip/postal code) (API docs)

Shows the sales tax rates for a given location.

Please note this method only returns the full combined rate for a given location. It does not support nexus determination, sourcing based on a ship from and ship to address, shipping taxability, product exemptions, customer exemptions, or sales tax holidays. We recommend using

taxForOrderto accurately calculate sales tax for an order.

client.ratesForLocation('90002').then(res => {

res.rate; // Rate object

});List nexus regions (API docs)

Lists existing nexus locations for a TaxJar account.

client.nexusRegions().then(res => {

res.regions; // Array of nexus regions

});Validate an address (API docs)

Validates a customer address and returns back a collection of address matches. Address validation requires a TaxJar Plus subscription.

client.validateAddress({

country: 'US',

state: 'AZ',

zip: '85297',

city: 'Gilbert',

street: '3301 South Greenfield Rd'

}).then(res => {

res.addresses; // Array of address matches

});Validate a VAT number (API docs)

Validates an existing VAT identification number against VIES.

client.validate({

vat: 'FR40303265045'

}).then(res => {

res.validation; // Validation object

});Summarize tax rates for all regions (API docs)

Retrieve minimum and average sales tax rates by region as a backup.

This method is useful for periodically pulling down rates to use if the TaxJar API is unavailable. However, it does not support nexus determination, sourcing based on a ship from and ship to address, shipping taxability, product exemptions, customer exemptions, or sales tax holidays. We recommend using

taxForOrderto accurately calculate sales tax for an order.

client.summaryRates().then(res => {

res.summary_rates; // Array of summarized rates

});By default, TaxJar's API will respond to requests with the latest API version when a version header is not present on the request.

To request a specific API version, include the

x-api-versionheader with the desired version string.

client.setApiConfig('headers', {

'x-api-version': '2020-08-07'

});You can easily configure the client to use the TaxJar Sandbox:

// CommonJS Import

const Taxjar = require('taxjar');

// ES6 Import

import Taxjar from 'taxjar';

const client = new Taxjar({

apiKey: process.env.TAXJAR_SANDBOX_API_KEY,

apiUrl: Taxjar.SANDBOX_API_URL

});For testing specific error response codes, pass the custom X-TJ-Expected-Response header:

client.setApiConfig('headers', {

'X-TJ-Expected-Response': '422'

});client.taxForOrder({

from_country: 'US',

from_zip: '07001',

from_state: 'NJ',

from_city: 'Avenel',

from_street: '305 W Village Dr',

to_country: 'US',

to_zip: '07446',

to_state: 'NJ',

to_city: 'Ramsey',

to_street: '63 W Main St',

amount: 16.50,

shipping: 1.5,

line_items: [

{

id: '1',

quantity: 1,

product_tax_code: '31000',

unit_price: 15.0,

discount: 0,

sales_tax: 0.95

}

]

}).then(res => {

res.tax; // Tax object

res.tax.amount_to_collect; // Amount to collect

}).catch(err => {

err.detail; // Error detail

err.status; // Error status code

});In TypeScript, you may want to first check the error's type before handling:

client.taxForOrder(/* ... */)

.catch(err => {

if (err instanceof Taxjar.Error) {

err.detail; // Error detail

err.status; // Error status code

} else {

// handle non-taxjar error

}

});npm test

To validate API methods in the TaxJar sandbox environment, pass the following environment variables:

TAXJAR_API_URL="https://api.sandbox.taxjar.com" \

TAXJAR_API_KEY="9e0cd62a22f451701f29c3bde214" \

npm test