Calculate VAT at checkout and allow customers with a VAT Number to avoid the tax. This plugin adds a new section on the Membership Checkout form titled "European Union Residents VAT".

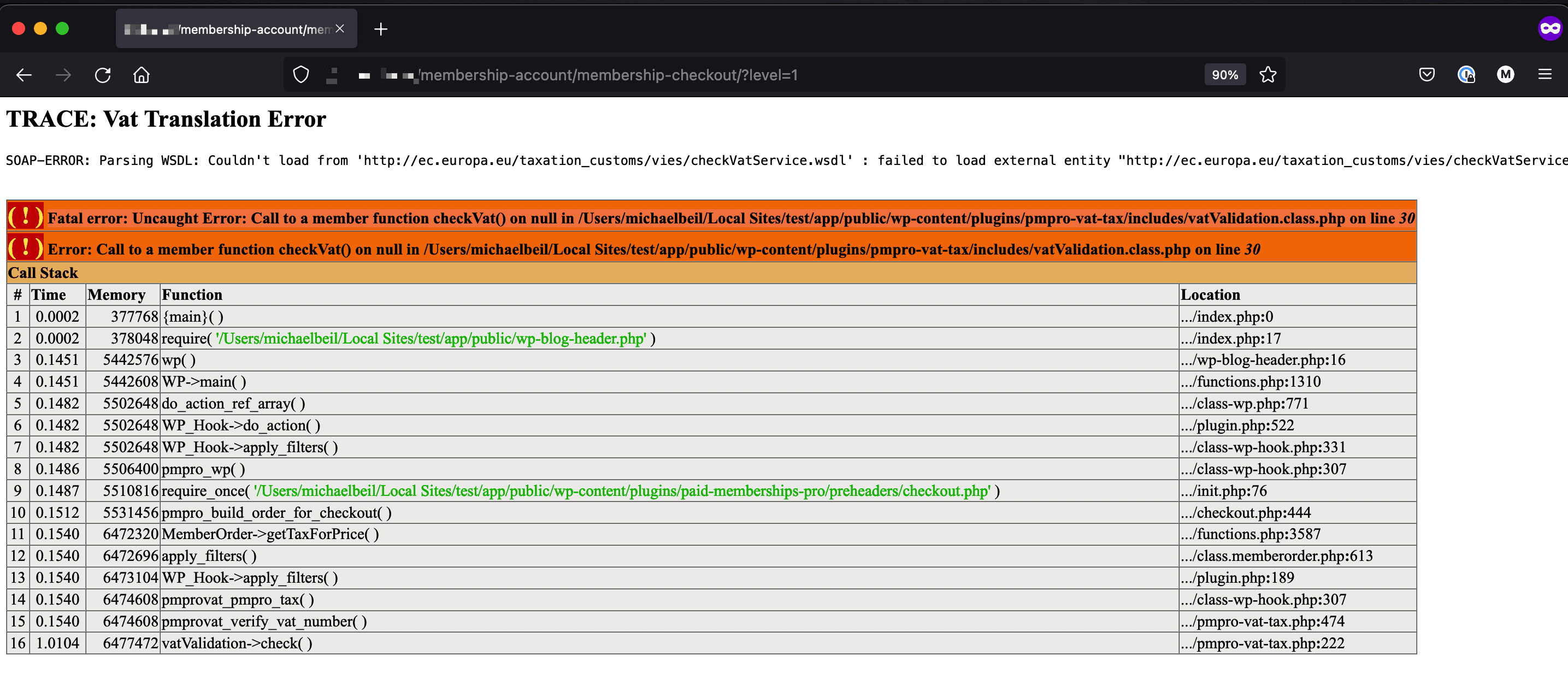

The customer can select their EU country of residence from a drop-down box or enter their VAT number to avoid the tax. The entered VAT number is validated using the SOAP service provided through the European Commission (https://ec.europa.eu/taxation_customs/vies/technicalInformation.html).

For more information please visit paidmembershipspro.com/add-ons/vat-tax/

For detailed installation steps, visit the documentation page.

- Download the current development ZIP file directly:

https://github.com/strangerstudios/pmpro-vat-tax/archive/dev.zip

Please ensure that once installing this version of the plugin to remove -dev from the plugin's folder name.

If you find an issue/bug, let us know by creating a detailed GitHub issue.

This is a developer's portal for Paid Memberships Pro - VAT (Value Added Tax) Add On. We do not offer support on this channel. Any support related questions should be directed to paidmembershipspro.com/support.

We encourage and welcome any contribution to Paid Memberships Pro - VAT (Value Added Tax) Add On. Please read the guidelines for contributing to this repository.

There are various ways to the help development of Paid Memberships Pro - VAT (Value Added Tax) Add On:

- Report bugs/issues on GitHub.

- Work on any issues by submitting a Pull Request.

Here are some ways for non-developers to contribute to Paid Memberships Pro - VAT (Value Added Tax) Add On:

- Translate Paid Memberships Pro - VAT (Value Added Tax) Add On into your own language.

- Purchase a paid membership to help fund ongoing development and bug fixes.