skfolio is a Python library for portfolio optimization built on top of scikit-learn. It offers a unified interface and tools compatible with scikit-learn to build, fine-tune, and cross-validate portfolio models.

It is distributed under the open source 3-Clause BSD license.

- Documentation: https://skfolio.org/

- Examples: https://skfolio.org/auto_examples/

- User Guide: https://skfolio.org/user_guide/

- GitHub Repo: https://github.com/skfolio/skfolio/

skfolio is available on PyPI and can be installed with:

pip install -U skfolio

skfolio requires:

- python (>= 3.10)

- numpy (>= 1.23.4)

- scipy (>= 1.8.0)

- pandas (>= 1.4.1)

- cvxpy (>= 1.4.1)

- scikit-learn (>= 1.3.2)

- joblib (>= 1.3.2)

- plotly (>= 5.15.0)

Since the development of modern portfolio theory by Markowitz (1952), mean-variance optimization (MVO) has received considerable attention.

Unfortunately, it faces a number of shortcomings, including high sensitivity to the input parameters (expected returns and covariance), weight concentration, high turnover, and poor out-of-sample performance.

It is well known that naive allocation (1/N, inverse-vol, etc.) tends to outperform MVO out-of-sample (DeMiguel, 2007).

Numerous approaches have been developed to alleviate these shortcomings (shrinkage, additional constraints, regularization, uncertainty set, higher moments, Bayesian approaches, coherent risk measures, left-tail risk optimization, distributionally robust optimization, factor model, risk-parity, hierarchical clustering, ensemble methods, pre-selection, etc.).

With this large number of methods, added to the fact that they can be composed together, there is a need for a unified framework with a machine learning approach to perform model selection, validation, and parameter tuning while reducing the risk of data leakage and overfitting.

This framework is built on scikit-learn's API.

- Portfolio Optimization:

- Naive:

- Equal-Weighted

- Inverse-Volatility

- Random (Dirichlet)

- Convex:

- Mean-Risk

- Risk Budgeting

- Maximum Diversification

- Distributionally Robust CVaR

- Clustering:

- Hierarchical Risk Parity

- Hierarchical Equal Risk Contribution

- Nested Clusters Optimization

- Ensemble Methods:

- Stacking Optimization

- Expected Returns Estimator:

- Empirical

- Exponentially Weighted

- Equilibrium

- Shrinkage

- Covariance Estimator:

- Empirical

- Gerber

- Denoising

- Detoning

- Exponentially Weighted

- Ledoit-Wolf

- Oracle Approximating Shrinkage

- Shrunk Covariance

- Graphical Lasso CV

- Implied Covariance

- Distance Estimator:

- Pearson Distance

- Kendall Distance

- Spearman Distance

- Covariance Distance (based on any of the above covariance estimators)

- Distance Correlation

- Variation of Information

- Prior Estimator:

- Empirical

- Black & Litterman

- Factor Model

- Uncertainty Set Estimator:

- On Expected Returns:

- Empirical

- Circular Bootstrap

- On Covariance:

- Empirical

- Circular bootstrap

- Pre-Selection Transformer:

- Non-Dominated Selection

- Select K Extremes (Best or Worst)

- Drop Highly Correlated Assets

- Cross-Validation and Model Selection:

- Compatible with all sklearn methods (KFold, etc.)

- Walk Forward

- Combinatorial Purged Cross-Validation

- Hyper-Parameter Tuning:

- Compatible with all sklearn methods (GridSearchCV, RandomizedSearchCV)

- Risk Measures:

- Variance

- Semi-Variance

- Mean Absolute Deviation

- First Lower Partial Moment

- CVaR (Conditional Value at Risk)

- EVaR (Entropic Value at Risk)

- Worst Realization

- CDaR (Conditional Drawdown at Risk)

- Maximum Drawdown

- Average Drawdown

- EDaR (Entropic Drawdown at Risk)

- Ulcer Index

- Gini Mean Difference

- Value at Risk

- Drawdown at Risk

- Entropic Risk Measure

- Fourth Central Moment

- Fourth Lower Partial Moment

- Skew

- Kurtosis

- Optimization Features:

- Minimize Risk

- Maximize Returns

- Maximize Utility

- Maximize Ratio

- Transaction Costs

- Management Fees

- L1 and L2 Regularization

- Weight Constraints

- Group Constraints

- Budget Constraints

- Tracking Error Constraints

- Turnover Constraints

The code snippets below are designed to introduce the functionality of skfolio so you can start using it quickly. It follows the same API as scikit-learn.

from sklearn import set_config

from sklearn.model_selection import (

GridSearchCV,

KFold,

RandomizedSearchCV,

train_test_split,

)

from sklearn.pipeline import Pipeline

from scipy.stats import loguniform

from skfolio import RatioMeasure, RiskMeasure

from skfolio.datasets import load_factors_dataset, load_sp500_dataset

from skfolio.model_selection import (

CombinatorialPurgedCV,

WalkForward,

cross_val_predict,

)

from skfolio.moments import (

DenoiseCovariance,

DetoneCovariance,

EWMu,

GerberCovariance,

ShrunkMu,

)

from skfolio.optimization import (

MeanRisk,

NestedClustersOptimization,

ObjectiveFunction,

RiskBudgeting,

)

from skfolio.pre_selection import SelectKExtremes

from skfolio.preprocessing import prices_to_returns

from skfolio.prior import BlackLitterman, EmpiricalPrior, FactorModel

from skfolio.uncertainty_set import BootstrapMuUncertaintySetprices = load_sp500_dataset()X = prices_to_returns(prices)

X_train, X_test = train_test_split(X, test_size=0.33, shuffle=False)model = MeanRisk()model.fit(X_train)

print(model.weights_)portfolio = model.predict(X_test)

print(portfolio.annualized_sharpe_ratio)

print(portfolio.summary())model = MeanRisk(

objective_function=ObjectiveFunction.MAXIMIZE_RATIO,

risk_measure=RiskMeasure.SEMI_VARIANCE,

)model = MeanRisk(

objective_function=ObjectiveFunction.MAXIMIZE_RATIO,

prior_estimator=EmpiricalPrior(

mu_estimator=ShrunkMu(), covariance_estimator=DenoiseCovariance()

),

)model = MeanRisk(

objective_function=ObjectiveFunction.MAXIMIZE_RATIO,

mu_uncertainty_set_estimator=BootstrapMuUncertaintySet(),

)model = MeanRisk(

min_weights={"AAPL": 0.10, "JPM": 0.05},

max_weights=0.8,

transaction_costs={"AAPL": 0.0001, "RRC": 0.0002},

groups=[

["Equity"] * 3 + ["Fund"] * 5 + ["Bond"] * 12,

["US"] * 2 + ["Europe"] * 8 + ["Japan"] * 10,

],

linear_constraints=[

"Equity <= 0.5 * Bond",

"US >= 0.1",

"Europe >= 0.5 * Fund",

"Japan <= 1",

],

)

model.fit(X_train)model = RiskBudgeting(risk_measure=RiskMeasure.CVAR)model = RiskBudgeting(

prior_estimator=EmpiricalPrior(covariance_estimator=GerberCovariance())

)model = NestedClustersOptimization(

inner_estimator=MeanRisk(risk_measure=RiskMeasure.CVAR),

outer_estimator=RiskBudgeting(risk_measure=RiskMeasure.VARIANCE),

cv=KFold(),

n_jobs=-1,

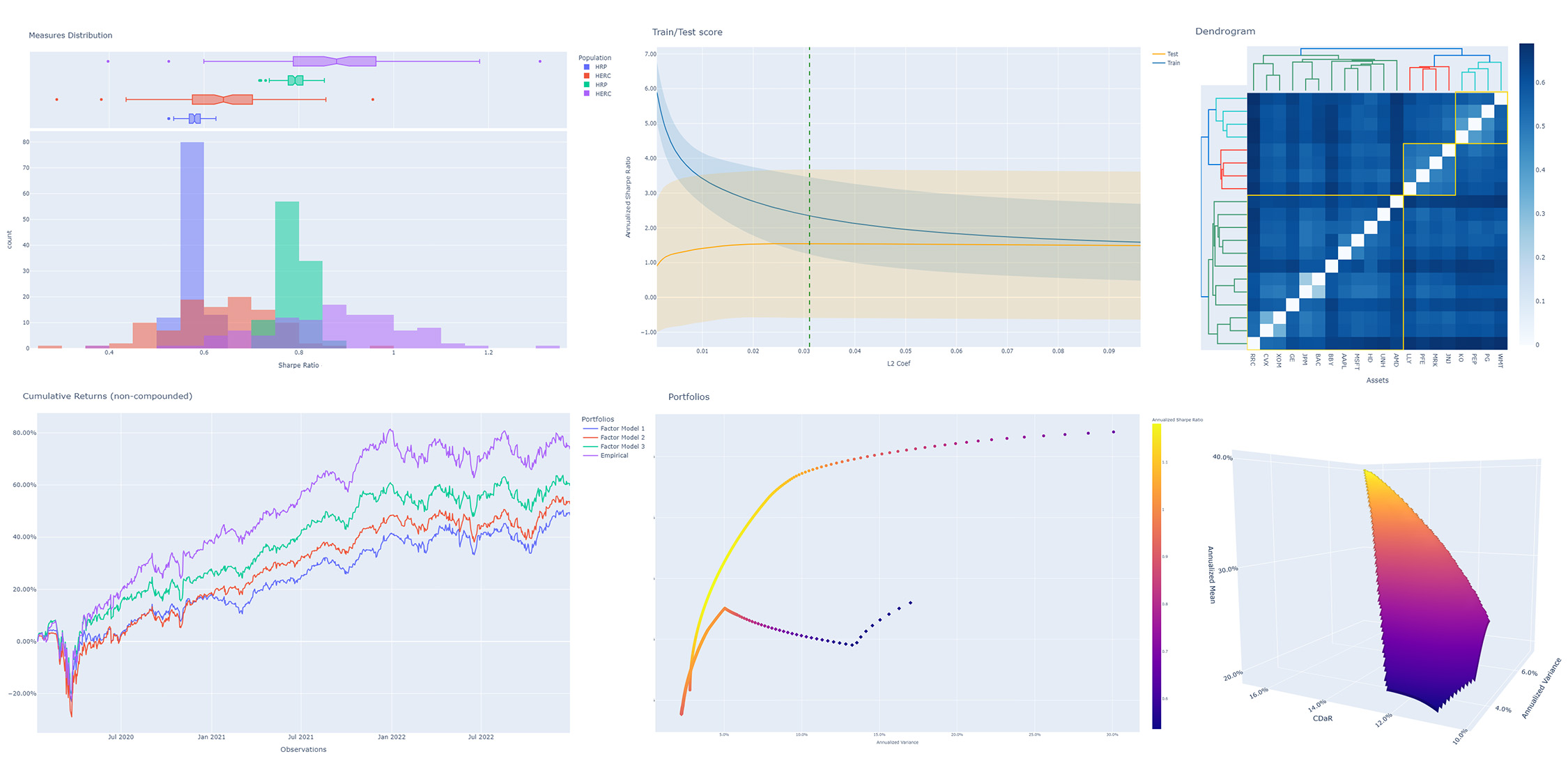

)randomized_search = RandomizedSearchCV(

estimator=MeanRisk(),

cv=WalkForward(train_size=252, test_size=60),

param_distributions={

"l2_coef": loguniform(1e-3, 1e-1),

},

)

randomized_search.fit(X_train)

best_model = randomized_search.best_estimator_

print(best_model.weights_)model = MeanRisk(

objective_function=ObjectiveFunction.MAXIMIZE_RATIO,

risk_measure=RiskMeasure.VARIANCE,

prior_estimator=EmpiricalPrior(mu_estimator=EWMu(alpha=0.2)),

)

print(model.get_params(deep=True))

gs = GridSearchCV(

estimator=model,

cv=KFold(n_splits=5, shuffle=False),

n_jobs=-1,

param_grid={

"risk_measure": [

RiskMeasure.VARIANCE,

RiskMeasure.CVAR,

RiskMeasure.VARIANCE.CDAR,

],

"prior_estimator__mu_estimator__alpha": [0.05, 0.1, 0.2, 0.5],

},

)

gs.fit(X)

best_model = gs.best_estimator_

print(best_model.weights_)views = ["AAPL - BBY == 0.03 ", "CVX - KO == 0.04", "MSFT == 0.06 "]

model = MeanRisk(

objective_function=ObjectiveFunction.MAXIMIZE_RATIO,

prior_estimator=BlackLitterman(views=views),

)factor_prices = load_factors_dataset()

X, y = prices_to_returns(prices, factor_prices)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.33, shuffle=False)

model = MeanRisk(prior_estimator=FactorModel())

model.fit(X_train, y_train)

print(model.weights_)

portfolio = model.predict(X_test)

print(portfolio.calmar_ratio)

print(portfolio.summary())model = MeanRisk(

prior_estimator=FactorModel(

factor_prior_estimator=EmpiricalPrior(covariance_estimator=DetoneCovariance())

)

)factor_views = ["MTUM - QUAL == 0.03 ", "VLUE == 0.06"]

model = MeanRisk(

objective_function=ObjectiveFunction.MAXIMIZE_RATIO,

prior_estimator=FactorModel(

factor_prior_estimator=BlackLitterman(views=factor_views),

),

)set_config(transform_output="pandas")

model = Pipeline(

[

("pre_selection", SelectKExtremes(k=10, highest=True)),

("optimization", MeanRisk()),

]

)

model.fit(X_train)

portfolio = model.predict(X_test)model = MeanRisk()

mmp = cross_val_predict(model, X_test, cv=KFold(n_splits=5))

# mmp is the predicted MultiPeriodPortfolio object composed of 5 Portfolios (1 per testing fold)

mmp.plot_cumulative_returns()

print(mmp.summary()model = MeanRisk()

cv = CombinatorialPurgedCV(n_folds=10, n_test_folds=2)

print(cv.get_summary(X_train))

population = cross_val_predict(model, X_train, cv=cv)

population.plot_distribution(

measure_list=[RatioMeasure.SHARPE_RATIO, RatioMeasure.SORTINO_RATIO]

)

population.plot_cumulative_returns()

print(population.summary())We would like to thank all contributors behind our direct dependencies, such as scikit-learn and cvxpy, but also the contributors of the following resources that were a source of inspiration:

- PyPortfolioOpt

- Riskfolio-Lib

- scikit-portfolio

- microprediction

- statsmodels

- rsome

- gautier.marti.ai

If you use skfolio in a scientific publication, we would appreciate citations:

Bibtex entry:

@misc{skfolio,

author = {Delatte, Hugo and Nicolini, Carlo},

title = {skfolio},

year = {2023},

url = {https://github.com/skfolio/skfolio}

}